Hammer

The Hammer candlestick is a bullish reversal pattern that forms after a downtrend. It has a small real body and a long lower shadow, indicating that sellers pushed prices lower during the session, but buyers managed to regain control and close near the opening price. This shows buying pressure and potential trend reversal.

Engulfing Pattern

The Engulfing Pattern is a strong reversal signal where a larger candle completely 'engulfs' the previous smaller candle. A bullish engulfing occurs after a downtrend and signals a potential upward reversal, while a bearish engulfing after an uptrend indicates a potential downward reversal.

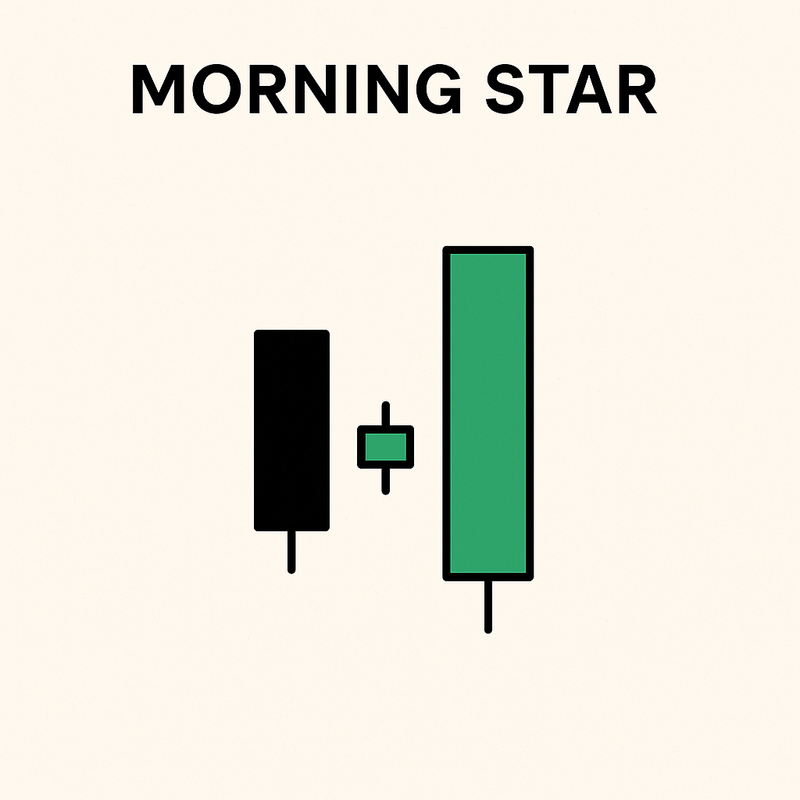

Morning Star

The Morning Star is a bullish reversal pattern made up of three candles: a large bearish candle, a small indecisive candle (star), and a large bullish candle. This indicates that selling pressure is diminishing and buying momentum is starting, signaling a possible trend reversal upward.

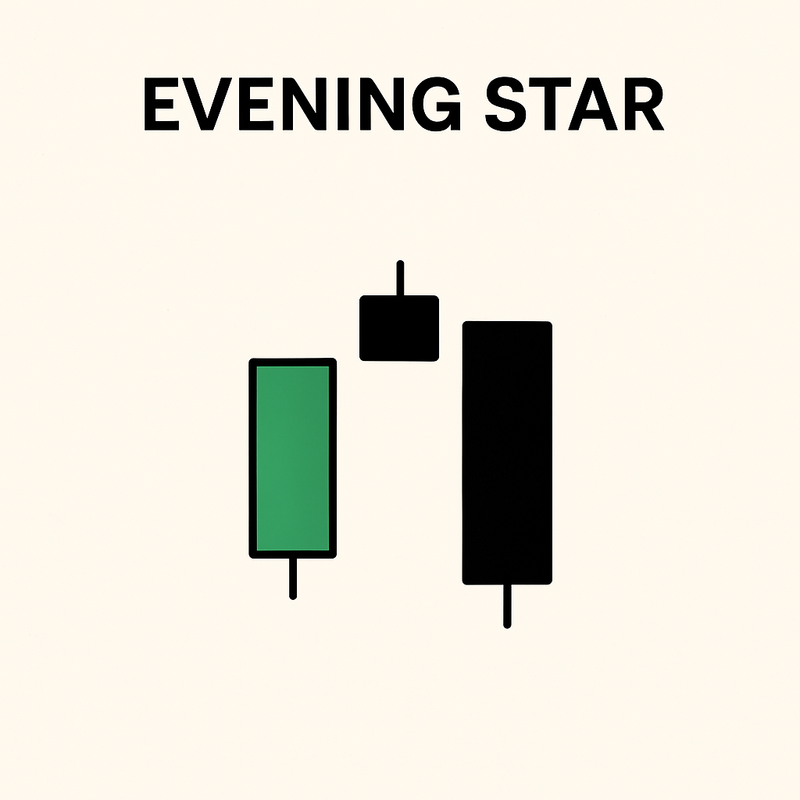

Evening Star

The Evening Star is a bearish reversal pattern composed of three candles: a large bullish candle, a small indecisive candle (star), and a large bearish candle. It signals that buying pressure is fading and sellers are gaining control, indicating a possible downward trend reversal.

Shooting Star

The Shooting Star is a bearish reversal pattern that occurs after an uptrend. It has a small real body near the bottom of the candle and a long upper shadow, showing that buyers pushed prices higher but sellers took control by the close. This often signals a trend reversal to the downside.